AMARCORD VINTAGE FASHION

Capital gains tax in the United States - Wikipedia, the free ...

Short-term capital gains are taxed at the investor's ordinary income tax rate and are defined as investments held for a year or less before being sold. Long-term .

http://en.wikipedia.org/wiki/Capital_gains_tax_in_the_United_States

Capital Gains Tax Rates: Tax Rates for Short-Term & Long-Term ...

Capital gains tax rates are determined by the type of investment asset and the holding period. Provides tax rates for short-term capital gains, long-term capital .

http://taxes.about.com/od/capitalgains/a/CapitalGainsTax_4.htm

252 Lafayette Street (btwn Prince & Spring)

Capital Gains Tax Rate Calculator

Short term gains on stock investments are taxed at your regular tax rate; long term gains are taxed at 15% for most tax brackets, and zero for the lowest two.

http://www.moneychimp.com/features/capgain.htm

Global Investments | Ireland Tax Rate | IDA Ireland

The Tax Rate in Ireland makes it a country that is very popular for Global Investments. Find out more here on IDAIreland.com.

http://www.idaireland.com/invest-in-ireland/tax-regime/

luxury conversion van rental texas

Is it better to invest in a tax-free or a taxable mutual fund?

For example, say you are in the 25 percent tax bracket and earn a pretax return of 10 percent on an investment. Your after-tax rate of return would be 7.5 percent, .

http://www.axa-equitable.com/investing/mutual-funds/tax-free-or-taxable-mutual-funds.html

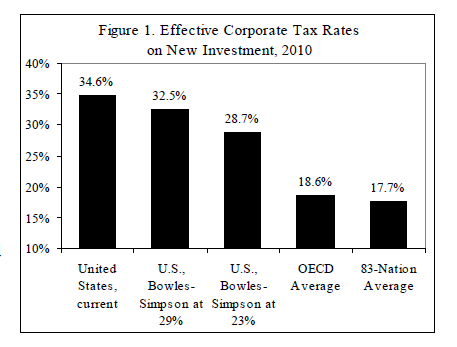

TAX POLICY — BELIEVE IN — AMERICA - Mitt Romney

recognize that because we tax investment at both the corporate and individual level, we should align our combined rates with those of competing nations.

http://www.mittromney.com/sites/default/files/shared/TaxPolicy.pdf

Hours: Mon-Fri 11-8 PM Sun 12-7 PM

Reporting Your Investment Earnings | Bankrate.com

Lower earning rates ease the pain of sharing your investment income with the IRS. . In some cases, however, the tax rate on investment income could be zero.

http://www.bankrate.com/finance/money-guides/reporting-your-investment-earnings-1.aspx

Pretax Rate Of Return Definition | Investopedia

The rate of return on an investment that does not take the taxes the investor must pay on this return. Because individuals' tax situations differ and different .

http://www.investopedia.com/terms/p/pretax-rate-of-return.asp

Phone: 888-254-DIGS (3447)

212-226-3363

halifax mortgage transfer

H & M

H&M Soho carries high fashion and quality at the

H&M Soho carries high fashion and quality at the

Taxation and Investment in India 2012 - Deloitte

there are sector-specific caps for investment, proposals for stakes up to those caps are automatically . rate of tax than a subsidiary or joint venture company.

http://www.deloitte.com/assets/Dcom-Global/Local%20Assets/Documents/Tax/Taxation%20and%20Investment%20Guides/2012/dttl_tax_guide_2012_India.pdf

Opening hours

Mon - Sat 10:00 AM - 9:00 PM

Sun 11:00 AM - 8:00 PM

558 Broadway between Prince and Spring

Romney's 13.9% Tax Rate Shows Power of Investment Tax ...

Jan 25, 2012 . Republican presidential candidate Mitt Romney's 2010 tax returns and the 13.9 percent rate he paid highlight how wealthy investors can use .

http://www.bloomberg.com/news/2012-01-24/romney-paid-13-9-percent-tax-rate-on-21-6-million-2010-income.html

Phone: +1-212 343 2722

risk management of internet banking

The 3.8% Tax - National Association of Realtors

Formula: The new tax applies to the LESSER of. Investment income amount. Excess of AGI over the $200,000 or $250,000 amount. New Tax Rate: .

http://www.realtor.org/small_business_health_coverage.nsf/docfiles/government_affairs_invest_inc_tax_broch.pdf/$FILE/government_affairs_invest_inc_tax_broch.pdf

New Investment Tax Slated for 2013 - SmartMoney.com

Jul 10, 2012 . These disguised tax increases will raise effective tax rates on investment income of higher-income individuals just that much more. Additional .

http://www.smartmoney.com/taxes/income/new-investment-tax-slated-for-2012-1341348347663/

Analysis: Like other investors, Romney enjoys lower income-tax rates

5 days ago . WASHINGTON (Reuters) - Living off your investments is a much better deal tax- wise in the United States than living off of a paycheck, as Mitt .

http://www.reuters.com/article/2012/09/21/us-usa-campaign-romney-investments-idUSBRE88K1C320120921

LEGACY

109 thompson st

Romney paid 14% effective tax rate in 2011 - Sep. 21, 2012

5 days ago . And that form of investment income is typically taxed at just 15%, well below the 35% top tax rate for high earners. To top of page .

http://money.cnn.com/2012/09/21/pf/taxes/romney-tax-return/index.html

Open every day from 12-7

Your Retirement Center: Investment Tax Planning

Don't overlook the tax consequences when you make investment decisions. . Short-term gains are taxed as ordinary income, at your regular tax rate.

http://www.mutualofamerica.com/lbp/finanplan/finanplan_tax_002.html

Basics of Tax-Free Investing - T. Rowe Price

How can investors gain exposure to tax-free investments in their portfolios? . case, coupon payments may be fixed or tied to a floating interest rate that resets .

http://individual.troweprice.com/public/Retail/Planning-&-Research/Tools-&-Resources/Investment-Planning/Basics-of-Tax-Free-Investing

Tax Policy and Investment Behavior - Stanford University

This cost depends on the rate of return, the price of investment goods, and the tax treatment of business income. Second, we determine empirically the relation .

http://www.stanford.edu/~rehall/Tax-Policy-AER-June-1967.pdf

Romney's 13.9% Tax Rate Shows Power of Investment Tax Preference

Feb 3, 2012 . (For more campaign coverage, see ELECT.) Jan. 24 (Bloomberg) -- Republican presidential candidate Mitt Romney's 13.9 percent tax rate in .

http://www.businessweek.com/news/2012-02-03/romney-s-13-9-tax-rate-shows-power-of-investment-tax-preference.html

(212) 966-8869

rental vacancy rates sacramento

ORIGINAL PENGUIN investment tax rate

Mitt Romney's effective tax rate is very low: Most economists think it ...

5 days ago . The main reason Romney's effective rate is so low is that the American tax code contains a lot of preferences for investment income over labor .

http://www.slate.com/blogs/moneybox/2012/09/21/mitt_romney_s_effective_tax_rate_is_very_low_most_economists_think_it_should_be_.html

Ordinary Income vs. Capital Gain Taxation - 1031 Exchange

With all investments, an important consideration is the amount of the investment return that the investor gets to keep after taxes that really matters. The tax rates .

http://apiexchange.com/index_main.php?id=8&idz=238

103 Greene Street

Investing Basics - Minimize Investment Taxes

You receive a cash dividend or have it automatically invested back into the security. Most dividends are subject to tax at maximum rate of 15%, although some .

https://www.wellsfargo.com/investing/basics/minimize_taxes

Low Capital Gains Tax Rates Cause Investment Bubbles

A look back through history of how extremely low capital gains tax rates have caused investment bubbles and even recessions.

http://www.hugdaily.org/brian-rogel/capital-gains-tax-rates-investment-bubbles

Investment Income Hasn't Always Had Tax Advantages - NYTimes ...

Jan 19, 2012 . That used to be the normal term for income from investments . Not until 2003 were dividend tax rates reduced below ordinary income tax rates.

http://www.nytimes.com/2012/01/20/business/investment-income-hasnt-always-had-tax-advantages.html?pagewanted=all

Corporate investment income tax rates- 2012

Corporate investment income tax rates* – 2012. Includes all rate changes announced up to 30 June 2012. * Rates represent calendar-year rates unless .

http://www.ey.com/Publication/vwLUAssets/Tax_Rate_Card_-_2012_Corporate_Investment/$FILE/Tax-Rates-Corporate-Investment-2012.pdf

Obama's Tax Rates on Investment would exceed Clinton's Rates ...

Sep 6, 2012 . Bill Clinton's speech last night reminded Americans of the many good things that happened while he was in office, including a booming .

http://taxfoundation.org/blog/obamas-tax-rates-investment-would-exceed-clintons-rates

Capital Gains Rules for Investment Property | Home Guides | SF Gate

Whether your profit on investment property sales is $50,000 or $500,000, your federal tax rate, as of 2010, is limited to 15 percent. There are no limitations on the .

http://homeguides.sfgate.com/capital-gains-rules-investment-property-1966.html

463 Broome Street

New York / NY 10013

Phone: 212 966 1722

Issues 2012 | The Dangers of Raising Taxes on Investment Incomes

The administration has suggested increasing the tax rate on two major categories of investment income. Long-term capital gains tax rates would rise from 15 to .

http://www.manhattan-institute.org/html/ir_5.htm

Get Ready for the New Investment Tax - WSJ.com

Jul 2, 2012 . 1, 2013, the tax rates on long-term capital gains and dividends for these earners will . How does the 3.8% tax on investment income work?

http://online.wsj.com/article/SB10001424052702304830704577496580986417316.html

451 Broome St.

Looming battle over investment taxes - May. 10, 2012

May 10, 2012 . A hike in investment tax rates "could spark a new wave of volatility in our . the 15 % investment tax rate for everyone except those making more .

http://money.cnn.com/2012/05/10/news/economy/investment-taxes/index.htm

Long-Term Capital Gains Tax Rates Guide - Investing for Beginners ...

The long-term capital gains tax rate paid on investments such as bonds, stocks, and mutual funds is lower than most other tax rates because the government .

http://beginnersinvest.about.com/od/capitalgainstax/ss/capital-gains-tax-rates_3.htm

Tax Topics - Topic 553 Tax on a Child's Investment Income

Aug 11, 2012 . If the child's interest, dividends, and other investment income total more than $1,900, part of that income may be taxed at the parent's tax rate .

http://www.irs.gov/taxtopics/tc553.html

Tax Savings As An Investment Banker: Good Luck | Mergers ...

Guide to saving on taxes as an investment banking analyst or associate: it's . for previously and since the same income level is subject to a lower tax rate if you .

http://www.mergersandinquisitions.com/investment-banker-tax-savings/

Obama's Tax Rates on Investment would exceed Clinton's Rates ...

Sep 6, 2012 . Bill Clinton's speech last night reminded Americans of the many good things that happened while he was in office, including a booming .

http://taxfoundation.org/blog/obamas-tax-rates-investment-would-exceed-clintons-rates

351 West Broadway

New Medicare Taxes on the Horizon - Visit Saf.wellsfargoadvisors ...

Investor's tax rate in excess of threshold. 0.00. 3.80. Thresholds for new taxes†. Employee compensation. Self-employment income. Investment income. Current .

https://saf.wellsfargoadvisors.com/emx/dctm/Marketing/Marketing_Materials/Life_Events_Planning/e6955.pdf

Consumption, Saving, and Investment, Part 1

higher rate of return is a greater reward for saving. . The expected after-tax real interest rate is given by: . Need to understand investment to understand the .

http://emlab.berkeley.edu/users/webfac/wood/e100b_f08/consumption.pdf

SAO

112 Wooster Street

Phone: 212-334-0456

TSE

120 Wooster Street

The Rate-Making Treatment of the Investment Tax Credit for ... - JStor

qualified investments, the prospective rate of return is increased and the project becomes more desirable. In general the investment tax credit oper- .

http://www.jstor.org/stable/2352178

Capital Gain Tax Rate Increases in 2013

Beginning January 1, 2013, the tax rate will revert from the current 15 percent rate . Under the law, the investment tax provisions in Chapter 2A of the Internal .

http://apiexchange.com/index_main.php?id=8&idz=236

JOHN VARVATOS

122 Spring Street

Phone: 212-965-0700

ALEXIA CRAWFORD ACCESSORIES

199 Prince Street

Phone: (212) 473-9703

ANN TAYLOR LOFT

560 Broadway

Phone: (212) 625-0427

ASH FRANCOMB

35 Crosby Street

Phone: (212) 334-3435

ANNE FONTAINE

93 Greene Street

Phone: (212) 343-3154

BAGUTTA LIFE

72 Greene Street

Phone: (212) 925-5216

BELIEVE IT NYC

529 Broome Street

Phone: (212) 334-7223

BETSEY JOHNSON SOHO

138 Wooster Street

Phone: (212) 995-5048

BICHE DE BERE

482 West Broadway

Phone: (212) 598-0571

BIG DROP

174 Spring Street

Phone: (212) 226-9292

BIG DROP

425 West Broadway

Phone: (212) 226-9292

BLOOMINGDALE’S

504 Broadway

Phone: (212) 705-2000

BUFFALO CHIPS

355 West Broadway

Phone: (212) 625-8400

Short-Term Capital Gains Tax Rates Guide - Investing for Beginners ...

The short-term capital gains tax rate is based upon your personal income tax rate and applies to stocks or other investments that have been held for less than .

http://beginnersinvest.about.com/od/capitalgainstax/ss/capital-gains-tax-rates_2.htm

106 Wooster Street

Phone: (212) 965-5330

THE EFFECTS OF TAXES AND RATES OF ... - National Tax Journal

(1980), do not explicitly consider the tax spect to tax rates and rates of return, for- impacts and tend to focus on U.S. direct eign direct investment through new .

http://ntj.tax.org/wwtax/ntjrec.nsf/C2A818CDD35728E08525686C00686D8E/$FILE/v41n1109.pdf

406 Broome Street

Phone: (212) 925-6200

CALYPSO ST. BARTH

280 Mott Street

Phone: (212) 965-0990

CALYPSO AU MARCHE

426 Broome Street

Phone: (212) 941-9700

CHANEL BOUTIQUE

130 Spring Street

Phone: (212) 334-0055

CHRISTOPHER FISCHER

80 Wooster

Phone: (212) 965 9009

CLEO & PATEK

367 West Broadway

Phone: (212) 431-7541

CRUMPLER

45 Spring Street

Phone: (212) 334-9391

CUSTO BARCELONE BOUTIQUE

474 Broome Street

Phone: (212) 274-9700

D&G DOLCE & GABBANA

434 West Broadway

Phone: (212) 965-8000

DAFFY’S

462 Broadway

Phone: (212) 334-7444

DETOUR-LADIES’

154 Prince Street

Phone: (212) 966-3635

DETOUR-MEN’S

425 West Broadway

Phone: (212) 219-2692

DETOUR-WOMEN’S

472 West Broadway

Phone: (212) 979-6315

DKNY

420 West Broadway

Phone: (646) 613-1100

DO KHAM: THE TIBET EMPORIUM

51 Prince

Phone: (212) 966-2404

DOSA

107 Thompson

Phone: (212) 431-1733

EARL JEAN

160 Mercer

Phone: (212) 226-8709

EILEEN FISHER

395 West Broadway

Phone: (212) 431-4567

FELICIA FARRAR

25 Thompson

Phone: (212) 560-9128

FLYING A

169 Spring

Phone: (212) 965-9090

FORAVI

542 Broadway

Phone: (212) 966-1970

FRENCH CONNECTION

435 West Broadway

Phone: (212) 219-1197

IVAN GRUNDAHL/LINEA S

94 Grand Street

Phone: (212) 334-4964

GUESS?

537 Broadway

Phone: (212) 226-9545

HEAD PORTER

140 Wooster Street

Phone: (212) 995-8108

HELIANTHUS

196 Spring Street

Phone: (212) 966-6435

HUGO HUGO BOSS

132 Greene Street

Phone: (212) 965-1300

IF... SOHO NY

94 Grand

Phone: (212) 334-4964

INA

101 Thompson

Phone: (212) 941-4757

INSTITUT

97 Spring Street

Phone: (212) 431-5521

J. CREW

99 Prince Street

Phone: (212) 966-2739

J. LINDEBERG

126 Spring Street

Phone: (212) 625-9403

JACK SPADE

56 Greene Street

Phone: (212) 625-1820

JILL STUART

100 Greene

Phone: (212) 343-2300

JJ TURK

510 Broome

Phone: (212) 625-9454

JNBY

75 Greene Street

Phone (212) 219-2529

KABAY

339 West Broadway

Phone: (212) 925-9631\

KAORI'S CLOSET

71 West Houston Street

Phone: (212) 387-7788

KATE SPADE

454 Broome Street

Phone: (212) 274-1991

KAZUYO NAKANO

117 Crosby Street

Phone: (212) 941-7093

KEIKO NEW YORK

62 Greene Street

Phone: (212) 226-6051

KENNETH COLE NEW YORK

597 Broadway

Phone: (212) 965-0283

KORS

159 Mercer

Phone: (212) 966-5880

LAUNDRY by Shelli Segal

97 Wooster

Phone: (212) 334-9433

LINUS

160 Spring Street

Phone: (917) 237-0222

LIORA MANNE

91 Grand Street

Phone: (212) 965-0302

LOOPY MANGO

Tax-Free Investments

Where You Gain on Tax-Free Investments . If interest rate on newer bonds is higher than the rate on the bonds you own, you might have to sell for less than par .

http://www.morganstanleyindividual.com/education/taxes/taxfree/lbp_tax102.html

Phone: (212) 343-7425

LOUNGE

593 Broadway

Phone: (212) 226-7585

LUCKY BRAND DUNGAREES

38 Greene Street

Phone: (212) 625-0707

LYNN PARK

51 Wooster Street

Phone: (212) 965-5133

m0851

115 Mercer

Phone: (212) 431-3069

MALO

125 Wooster Street

Phone: (212) 941-7444

MANKIND

8 Greene Street

Phone: (212) 966-5146

MARC JACOBS

163 Mercer

Phone: (212) 343-1490

Tax Rate Uncertainty and Investment Behavior

Downloadable! This paper deals with the effects of tax rate uncertainty on risk- neutral and risk-averse investment behavior. We analyze effects of stochastic tax .

http://ideas.repec.org/p/ces/ceswps/_557.html

65 Mercer

Phone: (212) 431-4120

MARITHE + FRANCOIS GIRBAUD

47 Wooster

Phone: (212) 625-0066

MAX STUDIO

426 West Broadway

Phone: (212) 941-1141

MAXMARA

450 West Broadway

Phone: (212) 674-1817

MIU MIU

100 Prince

Phone: (212) 334-5156

NANETTE LEPORE BOUTIQUE

423 Broome Street

Phone: (212) 219-8265

NICOLE MILLER SOHO

77 Greene Street

Phone: (212) 219-1825

OLIVE AND BETTE’

158 Spring Street

Phone: (646) 613-8772

ONWARD SOHO

172 Mercer

Phone: (212) 274-1255

THE ORIGINAL LEATHER STORE

176 Spring

Phone: (212) 219-8210

PATAGONIA

101 Wooster Street

Phone: (212) 343-1776

PHAT FARM/BABY PHAT

129 Prince

Phone: (212) 533-7428

PLEATS PLEASE

128 Wooster

Phone: (212) 226-3600

PRADA

575 Broadway

Phone: (212) 334-8888

PUMA

521 Broadway

Phone: (212) 334-7861

QUICKSILVER-BOARDRIDERS CLUB

109 Spring Street

Phone: (212) 334-4500

RALPH LAUREN

379 West Broadway

Phone: (212) 625-1660

RAMPAGE

127 Prince Street

Phone: (212) 995-9569

REPLAY

109 Prince

Phone: (212) 673-6300

REVA MIVASAGAR

22-28 Wooster

Phone: (212) 334-3860

ROSEBUD

131 Thompson

Phone: (646) 602-1565

RUDE GIRL RIVE GAUCHE

237 Centre Street

Phone: (212) 226-0069

SAC BOUTIQUE

115 Grand Street

Phone: (212) 431-2576

SALVATORE FERRAGAMO

124 Spring Street

Phone: (212) 226-4330

SHARAGANO PARIS

529 Broadway

Phone: (212) 941-7086

SKECHERS

530 Broadway

Phone: (212) 431-8803

STACKHOUSE

276 Lafayette

Phone: (212) 925-6931

STELLA MCCARTNEY

112 Greene Street

Phone:

(212) 255 1556

STEVEN ALLAN

60 Wooster

Phone: (212) 334-6354

STUSSY

140 Wooster

Phone: (212) 995-8787

SUPREME

274 Lafayette

Phone: (212) 966-7799

SWISS ARMY SOHO

136 Prince

Phone: (212) 965-5714

TAG HEUER BOUTIQUE

422 West Broadway

Phone: ( 212) 965-5304

TED BAKER LONDON

107 Grand

Phone: (212) 343-8989

Cap gains the flash point in tax imbroglio - InvestmentNews

6 days ago . But a veteran of the last major tax reform in 1986 argued that the tax rate on investment gains must rise to a rate at or near the top individual .

http://www.investmentnews.com/article/20120920/FREE/120929995

440 Broadway

Phone: (212) 219-9966

UNION

172 Spring Street

Phone: (212) 226-8493

UNITED COLORS OF BENETTON

555 Broadway

Phone: (212) 941-8010

VIVIENNE TAM

Investment Taxation- Long-Term Tax Rates Set to Explode | Benzinga

Investment Taxation- Long-Term Tax Rates Set to Explode. George Mentz, Benzinga Contributor. July 16, 2012 1:41 PM. + Follow. Print. Email. Tickers: IVW, ROI .

http://www.benzinga.com/personal-finance/financial-advisors/12/07/2746820/investment-taxation-long-term-tax-rates-set-to-exp

Phone: (212) 966-2398

WOLFORD

122 Greene

Phone: (212) 343-0808

WORK IN PROGRESS

513 Broadway

Phone: (212) 343-2577

X-LARGE

267 Lafayette

Phone: (212) 334-4480

Y & KEI

125 Greene

Phone: (212) 477-7778

YASO

62 Grand

Phone: (212) 941-8506

YELLOW RAT BASTARD

478 Broadway

Phone: (212) 334-2150

YOHJI YAMAMOTO

103 Grand

Phone: (212) 966-9066

ZABARI

506 Broadway

Phone: (212) 431-7980

Childrens Clothing Stores

CALYPSO ENFANT

426 Broome

Phone: (212) 966-3234

JULIAN & SARA

103 Mercer

Phone: (212) 226-1989

LES PETITS CHAPELAIS

142 Sullivan

Phone: (212) 505-1927

LILLIPUT

265 Lafayette

Phone: (212) 965-9567

LILLIPUT SOHO KIDS

240 Lafayette

Phone: (212) 965-9201

MAKIE

109 Thompson

Phone: (212) 625-3930

PATAGONIA

101 Wooster

Phone: (212) 343-1776

Leather Stores

ARIZONA

91 Spring Street

Phone: (212) 941-7022

HUNTING WORLD

118 Greene

Phone: (212) 431-0086

IL BISONTE

120 Sullivan Street

Phone: (212) 966-8773

LE BO PARIS

135 Prince

Phone: (212) 979-0082

THE ORIGINAL LEATHER STORE

176 Spring

Phone: (212) 219-8210

PETER HERMANN LEATHER GOODS

118 Thompson

Phone: (212) 966-9050

SILVERADO

542 Broadway

Phone: (212) 966-4470

Lingerie Stores

BODYHINTS

462 West Broadway

Phone: (212) 777-8677

ERES

98 Wooster

Phone: (212) 431-7300

LE CORSET BY SELIMA

80 Thompson

Phone: (212)334-4936

Maternity Stores

PUMPKIN MATERNITY

407 Broome (at Lafayette)

Phone: (212) 334-1809

Vintage Clothing Stores

CHELSEA GIRL

63 Thompson

Phone: (212) 343-1658

PATINA

451 Broome

Phone: (212) 625-3375

WHAT GOES AROUND COMES AROUND

351 West Broadway

Phone: (212) 343-9303

![]()

Basics of Tax-Free Investing - T. Rowe Price

How can investors gain exposure to tax-free investments in their portfolios? . case, coupon payments may be fixed or tied to a floating interest rate that resets .

http://individual.troweprice.com/public/Retail/Planning-&-Research/Tools-&-Resources/Investment-Planning/Basics-of-Tax-Free-Investing

car rental philadelphia under 21![]()

![]()

The neighborhood rose to fame as a neighborhood for artists during the 1960s

Taxing Gold and Silver Investments

When you sell an investment in collectibles that you held for more than a year, your . The tax rate on capital gains depends on how long you held the asset.

http://www.tradersgame.com/articles/taxing-gold.html